The term ‘modern economics’ is widely overused and a bit presumptuous, considering that very little has changed in foundational models and assumptions for the last 80 years. Realities about electronic transfers, new manufacturing technology, nanosecond trading and aggregate real time personal banking data is yet to be incorporated in “modern economic” models. Thus, economics has become a normative discipline based on abstraction with little connection to reality, where the main focus is to argue about different theoretical approaches and ‘prove others wrong’ (not through empiricism) by applying complicated mathematical models; Inevitably deviating the discipline from its primary purpose, which is to deliver a system that elevates human quality of life while providing an ethically acceptable vehicle for mobility and power transfer in a civilized society. Economists have long enjoyed the luxury of subscribing to specific schools of thought that offered plausible models and explanations for existing and future market conditions based purely on theory. Those were the good old times when macroeconomic changes happened slowly and little or no data was available to support claims of any correlation between economic policy and equilibrium outcomes. The condition known as Ceteris Paribus [MS1] (rarely observed in macroeconomic markets) served as a plausible reason to claim positive changes as consequences of past economic policy. However, the 2008 financial crisis changed these assumptions by proving that existing epistemology has failed to produce at the most basic level, what any strong theoretical foundation should deliver:

- -Prediction of major market disruptions based on indicators severely deviated from the norm.

- – Formulation of corrective policy that can deliver expected results based on previous experiments

Needless to say that I am making reference to the faulted predictions relating to economic growth, employment rates, and shifts in the IS/LM promised by quantitative easing policies put in place after the financial crisis. To be fair, it is safe to assume that a much worse outcome could have resulted had governments not taken immediate action. However, it is hard to assess the extent of ‘success’ of this policy when the recovery promised by neoliberal models is yet to be observed in the markets, an issue that has severely undermined the credibility of the economics profession. This new reality brings a bit of good and bad news for so called “modern economic theory.” The bad news is that the success or failure of previously applied models has created an array of new challenges that promise to shake the foundations of existing assumptions, given the extent of their significance and their simultaneous interactions. The good news is that this new paradigm will provide the economics profession a chance to redeem itself, by requiring scholars to step out of their comfort zone and into the waters of pluralism in order to avoid catastrophic consequences.

The modern paradigm in the making is composed of major economic and social challenges, that for practical purposes will be called variables, X, Y, Z and L. Each one of these variables is a real threat to any advancement achieved by societal superstructures in the past, either by deployment of rigorous methodology or by simple chance. The variables detailed below are challenges faced before by existing theory. However, this time they will unravel parallel to each other at unprecedented magnitudes and speed during the next forty years.

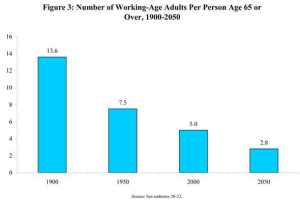

Variable X- Global increase in the proportion of retired population in the next four decades. Recent research published by the US Immigration Policy center indicates that the percentages of aging population is bound to double at a global scale in the next 40 years. In the US alone, the elderly will make up to ¼ of the total population. Data extracted from the Immigration Policy Research Institute shows how at the same time the ratio of working adults per retiree will be cut by more than half due to diminishing birth ratios over the years. This ratio goes from 7.5 working adults in 1950, to 2.8 working adults per retired person in 2050.

Walter A. Ewing, PhD. “The future of a generation.” Immigration Policy Center. immigrationpolicy.org. Feb, 2012. Web, May, 2015

The National Institute of Aging states that “while global aging represents a triumph of medical, social, and economic advances over disease, it also presents tremendous challenges. Population aging strains social insurance and pension systems and challenges existing models of social support. It affects economic growth, trade, migration, disease patterns and prevalence, and fundamental assumptions about growing older.” This of course implies severe economic ramifications that include an increased tax burden on the working population, creating a gap that needs to be filled by a change in policy. The current social security and medicate system depends on working people to support care and government transfers to the growing elderly population. Which takes us directly to the problem with variable ‘L.’

Variable L- Technological disruptions and increased automation of unskilled labor. Finding the resources to fund the care of a growing global aging population could be somewhat addressed by improved wages of working people or increasing the retirement age assuming a fairly strong labor market. However, technological disruptions are clearly pointing to an increased number of unskilled labor being replaced by automation, pushing wages down. This will most likely result on having to work more hours to attain basic sustenance, in a market where labor demand is shrinking and taxes are increasing. This situation complicates things even further for dominant classic economic theory. Technological change combined with increases in the aging population points to a future where the percentage of people, old and young in need of social services, may be a much larger than the population with jobs to support their welfare. How will full employment be attained in such circumstances? Will it be sufficient to sustain the current fee market system? The biggest moral challenge will be to devise a ‘fair distribution’ of resources given that the level of unemployment is created from within the system and not by an absence of desire to work. Depriving certain groups from sustenance in a world of automated abundance seems like a highly unethical response to this new paradigm, where supply of labor will greatly surpass demand for a very long time. So if labor is no longer the driving engine of the future economy, how will demand and equilibrium be determined? Is there a point where downward wage pressure will erode labor’s monetary value so much, that people’s time would be better spent building things for themselves instead of buying them? These questions are vital to the study of economics, which is the essential element through which societies organize and thrive, or perish.

Variable Y-Climate change disruptions. Scientist have been warning for years about the risk of rising sea levels and disruptions to the global food supply caused by environmental degradation. So the world faces an increase in population, coupled by a shrinkage of land and resources. The Global Policy Journal warns: “Climate change will force reevaluations of present day governance agreements on trade, finance, food supply, security, development, environment, and similar sectors.” However, even if governments could someday agree to change some or all the regulations above, maintaining a balance between the environment and an ever growing human population inevitably requires slowing economic growth and promoting conservation. This reality poses an additional challenge to the prevailing economic theory. Social and economic well being can no longer depend on unlimited growth, it is necessary to find an alternative.

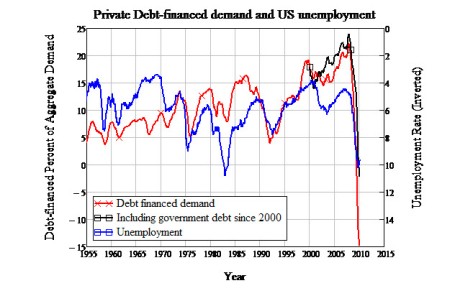

Variable Z- Repayment of private and public debt. left over from the 2008 crisis The quantitative easing policies applied by western governments during the 2008 crisis has left a the most powerful economies with public debt ratios of over 200% of GDP and a private household debt bubble that surpasses 300% of GDP. This is very concerning since both public and private debt imply a promise to allocate future income to nonproductive means. This translates to increased taxes and reduced consumption due to a budget line constrained by large debt. Needless to say that debt and taxation directly diminishes the money multiplier, consumer demand and indirectly affects the demand for labor in a negative way. Recent research based on Misnky’s Financial Instability Theory, demonstrates the correlation between employment and debt, concluding that consumer demand and employment are highly dependent on it.

Steve Keen. “Why debt to GDP Ratios Matter.” Incrediblecharts.com. 2014. Web May, 2015

Steve Keen. “Why debt to GDP Ratios Matter.” Incrediblecharts.com. 2014. Web May, 2015

The graph above reveals several implications:

- Employment is highly dependent on household debt while debt ratios have reached unsustainable levels.

- Large portions of future production will be allocated to repayment of debt, leaving very little room for welfare taxation and reallocation of resources for social nets.

- Less disposable income can lead to a global deflation, which is not at all bad for the environment but can have disastrous consequences on current societal structure especially in one that is dependent on employment to support a growing number of retirees.

The issues listed above are only some of the challenges to the underlying assumptions behind “modern economic theory.” How to maintain the desired level of employment without growing consumption in order to protect the environment? How to provide for the elderly without resulting in outrageous tax rates that will stall market demand? How to achieve this while repaying outrageous amounts of debt. Free markets will have a hard time existing under such conditions. Unlimited growth and consumption of goods is not possible without environmental degradation. Market demand depends on employment levels which depend on unlimited growth and demand for labor which is being replaced by technology. So, how could a single theory solve these challenges simultaneously? It is clear that calling the predominant neoliberal model “modern” is a poor attempt to incorporate modifications without truly understanding the needs of modern societies. The economics profession ought to do better.

The world has moved on, so should fundamental assumptions of economic theory. There is no universal solution to all present and future economic challenges, and practicality is only met by evolution of thought. Modernity has brought many challenges to the economics profession along with an unprecedented gift, massive amounts of real time data. This innovation represents the long lost connection between justified beliefs and the reality of outcomes. It is time to put modernity into economics theory by incorporating aggregate real time data to objectively look at what works, why it works, and how it can be improved. Being that existing theories may only solve for one variable at the time, the rebirth of ‘modern economics’ may be marked by a different approach based on pluralism and objectivity instead of dogmatism and abstraction.

[MS1]According to Investopedia Online “all other things being equal”

It’s hard to disagree with the thought that ‘modern economics’ has stepped into the vacated shoes of the Astrologers. The Austrian economists seem to have done rather better, treating the subject as an aspect of human behavior but their product fails to provide cover for politicians while too many of its conclusions are not what people prefer to hear. little glory in that …

It seems to me that modern Malthusians face the same trap that did for the originals: an assumption of inadequacy of future resources relative to population; that assumption failed. It also seems possible that the present and future conditions will limit population reproduction rates, at least for a while. So many dependent variables!

And the folks playing with genetics and brain imaging may start messing with human behavior alteration, dismantling even the Austrian economists. I have no idea what may come but assume that it will be interesting …

LikeLike

Jack, I would love to hear your feedback regarding the new article I published related to monetary reform .https://forwardeconomics.net/2016/05/25/economic-model/

LikeLike

I have since published an essay on the robotic era of possibly high unemployment here:

http://www.fin24.com/Economy/End-of-life-as-we-know-it-20150624

It is just a bit of fun and is not padded out with any serious research but it has made a huge impact.

As for going forward, my research group known as Macro-economic Design (MED) does take the subject of designing the economic framework and management systems a long way forward I believe and one only has to read the home page, the peer reviews and other pages and the links to see that.

LikeLike

This is one of the most important papers that I have read in recent years.

The implications are that politicians will have to be dragged into a whole new set of priorities, savings may have to be destroyed, robots take over the work force, and people work much more for themselves at home. Cities may lose their appeal as having your own land and personal farm becomes more useful than having a job.

But that is just wild guessing.

Life will not be the same next century as it is today. Retirement will, in terms of its current meaning, (ceasing to be employed), change its meaning. Age will not lead to an end of working, and youth will not mean employment.

As for the structure of economies and their dynamics, I am about the only person looking at that comprehensivley right now. Radical changes will be forced upon us very soon and I recommend reading my website and joining my discussion group, MACRO-ECONOMIC DESIGN to get a hold on that.

http://macro-economic-design.blogspot.com

LikeLike

Why go backwards when we can move forward?

LikeLike

Well, human progress seems to follow a sort of sine wave, at least to me. Perhaps a result of inability to consistently govern ourselves over time. A Phoenix of sorts …Perhaps it has overall survival value?

I note Stephen Hawking’s advice to get off-planet, out into the galaxy before some cosmic happenstance demolishes our home. We have the advice plus government capable of pursuing it, just as the economic mismanagement of government is about to multiply the difficulty of following the advice.

Put another way, perhaps economics is a useless theoretical construct because it is really about human behavior and that is subject first to politics, not economics? I see Nobel laureate economists carrying water for the politicians. Maybe sites like this will get things moving …

LikeLiked by 1 person

Edward , I would love to hear your thoughts about this new article I published. Quite radical for monetary reform.https://forwardeconomics.net/2016/05/25/economic-model/

LikeLike